what is the inheritance tax rate in virginia

Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. The estate tax was imposed on the transfer of a taxable estate at a rate equal to the maximum amount of the federal credit for state estate taxes as it existed on January 1.

Virginia Income Tax Calculator Smartasset

How much is federal tax on inheritance.

. This is great news for Virginia residents. The top estate tax rate is 20 percent exemption threshold. No estate tax or inheritance tax washington.

How much is federal tax on inheritance. The estate tax is a tax on a persons assets after death. The federal estate tax generally applies to assets over 1206 million in 2022 and 1292 million in 2023.

How much can you inherit without paying taxes in Virginia. No estate tax or inheritance tax washington. The top estate tax.

With the elimination of. How much can you inherit without paying taxes in Virginia. Unlike the federal estate tax where the estate pays the taxes.

How is personal property tax calculated on a car in virginia. How is personal property tax calculated on a car in virginia. In 2021 federal estate tax generally applies to assets over 117 million and the estate tax rate ranges from 18 to 40.

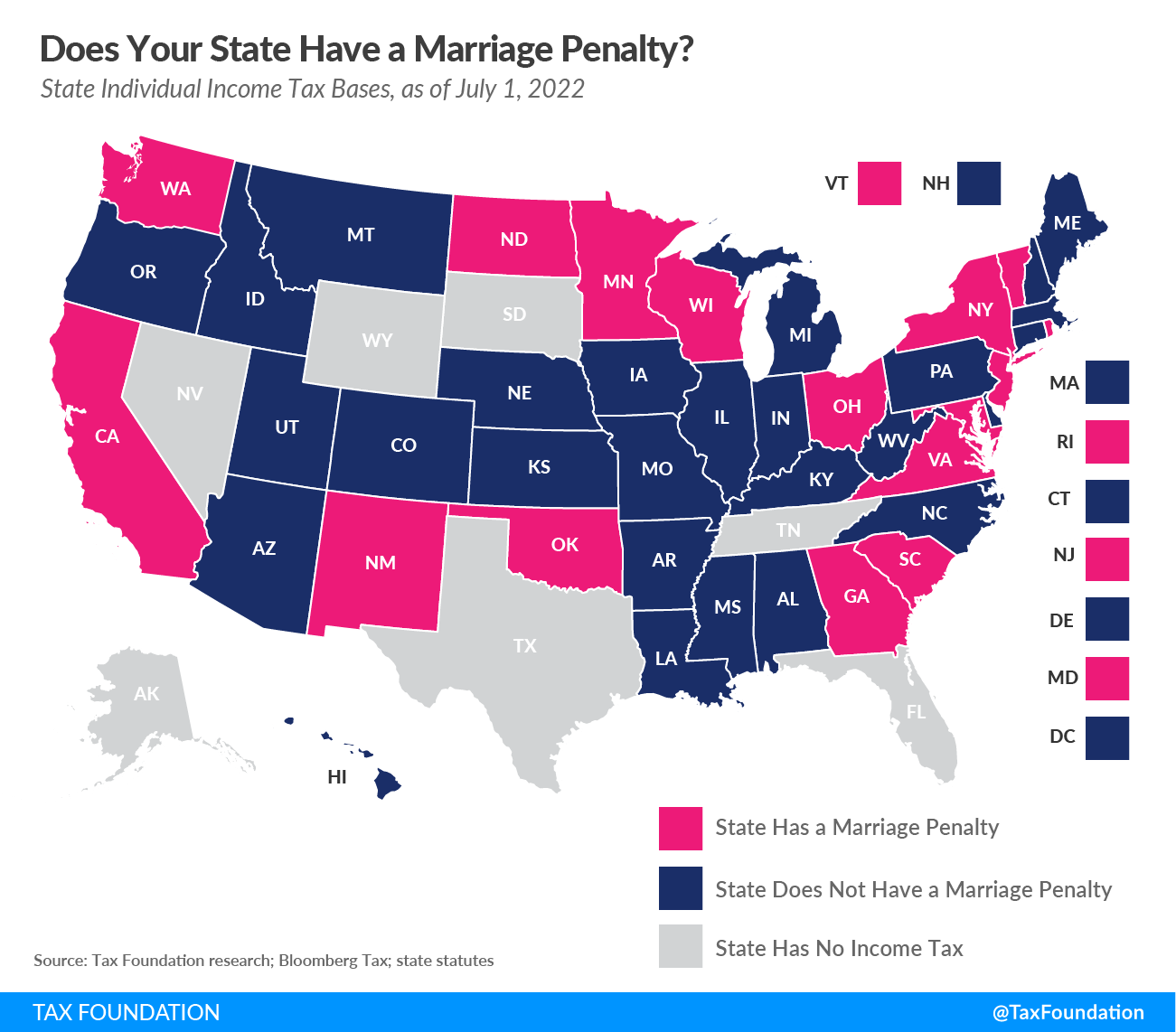

If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M. State inheritance tax rates range from 1 up to 16. Today Virginia no longer has an estate tax or inheritance tax.

Unlike the federal estate tax where the estate pays the taxes. There is no federal inheritance tax but there is a federal estate tax. 2193 million Washington DC District of Columbia.

The estate tax rate is 40. Price at Jenkins Fenstermaker PLLC by. In general all sales leases and rentals of tangible personal property in or for use in Virginia as well as accommodations and certain taxable services are subject to Virginia sales and use tax.

No estate tax or inheritance tax. The estate tax is a tax on a persons assets after death. This chapter shall be known and may be cited as the Virginia Estate Tax Act Code 1950 58-2381.

15 percent on transfers to other heirs except charitable organizations exempt institutions and government entities exempt. The estate tax is a tax on a persons assets after death. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

45 percent on transfers to direct descendants and lineal heirs. But just because Virginia does not have an estate tax does not mean one is not assessed at the federal level.

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

Virginia Tax Rates Rankings Virginia State Taxes Tax Foundation

Virginia State Tax Guide Kiplinger

Inheritance Tax Here S Who Pays And In Which States Bankrate

State Estate And Inheritance Taxes In 2014 Tax Foundation

What Reasons Are There For A Capitalist To Oppose A 100 Inheritance Tax Quora

Estate Taxes In Virginia Va Estate Tax Procedures

West Virginia Estate Tax Everything You Need To Know Smartasset

Estate Tax Exemption For 2023 Kiplinger

How Much Is Inheritance Tax Community Tax

New Irs Data Reiterates Shortcomings Of The Estate Tax Tax Foundation

State Estate And Inheritance Taxes Itep

Death And Taxes Nebraska S Inheritance Tax

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

The Federal Estate Tax A Critical And Highly Progressive Revenue Source Itep

Where Not To Die In 2022 The Greediest Death Tax States

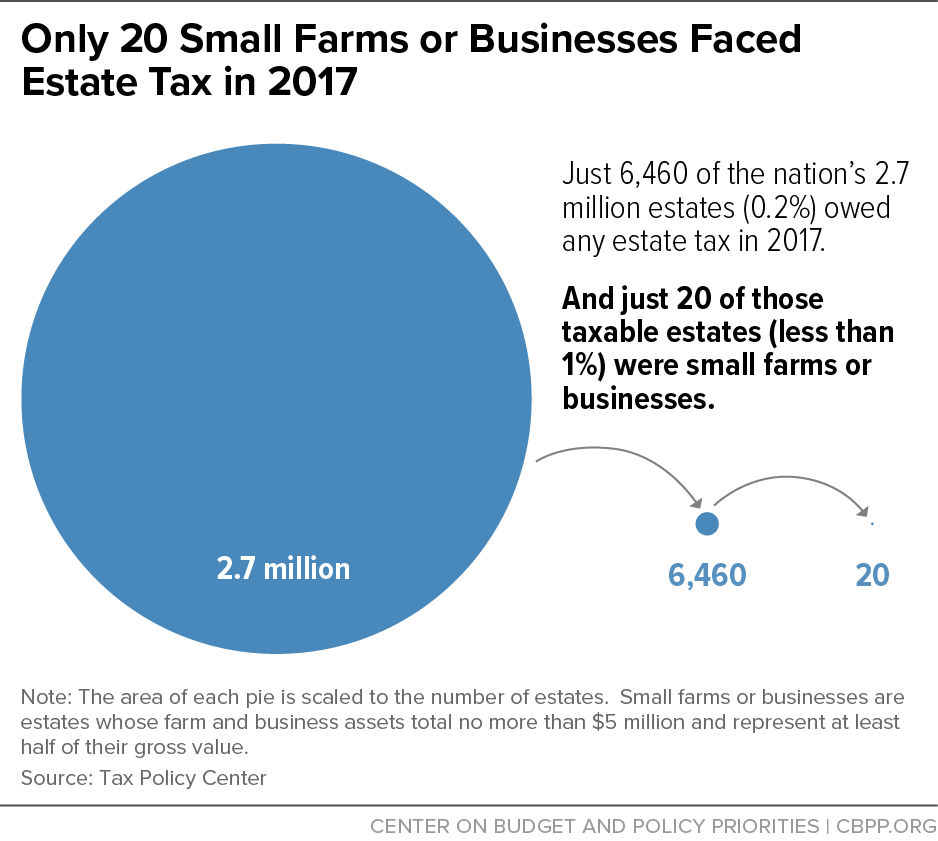

Policy Basics The Federal Estate Tax Center On Budget And Policy Priorities